Stop Buying Duplicates with Home Inventory Apps

If you keep rebuying things you already own, a home inventory app can fix it fast. Here’s how the system works, what to track, and five apps that make duplicates much harder to buy.

74 posts in this category

We just awarded Monee as Best Budget & Expense Tracker App 2025!

If you keep rebuying things you already own, a home inventory app can fix it fast. Here’s how the system works, what to track, and five apps that make duplicates much harder to buy.

Late fees on buy now, pay later plans are common—and easy to trigger when you’re juggling multiple due dates. Here’s a simple tracking workflow and five apps that help you stay ahead of every installment.

Home repairs can blow up your budget fast. Here’s how quote-comparison apps help you get fair pricing, avoid surprise fees, and pick the right pro—plus five apps I used to compare offers.

Gift spending adds up fast. Here’s a simple way to stay generous without blowing your budget: combine gift lists with “set-aside” categories using five apps I’ve tested, plus real stats and examples.

Out-of-network ATM use now averages $4.86 per withdrawal. Here’s how digital wallet apps can help you dodge common bank fees—ATM, overdraft, and FX—using five practical apps I’ve tested.

Big yearly bills don’t have to wreck your month. Learn how sinking funds turn annual costs into small monthly transfers, see why this matters with real stats, and compare five apps that make it simple.

Wardrobe apps turn your closet into data: what you own, what you actually wear, and what each piece costs per wear. Here are five apps I tested that help you pause, plan, and spend less.

Learn how unit pricing works, why it matters when grocery prices change, and how five barcode-scanner apps can help you compare price per ounce (or per 100g) faster in the aisle.

Round-up savings apps stash spare change automatically so your emergency fund grows without constant willpower. Here’s how round-ups work, what to watch for, and five apps I’d use—pros, cons, and real examples.

Cashback apps turn routine spending into real rewards—on groceries, gas, dining, and online shopping. Here’s how they work, what to watch for, and five apps you can use right away.

Irregular pay doesn’t have to break your budget. Learn a simple “baseline month” system, plus how five popular mobile apps handle cash-flow swings, rollovers, and recurring bills—without guesswork.

Returns aren’t “free” if you miss the deadline. Here’s a simple, app-based system to track deliveries, calculate return-by dates, and set reminders—plus five shopping apps that make it realistically hard to forget.

Groceries are pricey, and “we’ll figure it out later” gets messy fast. Here’s a simple, fair system to split costs using shared cart/list apps—plus five apps that make it painless.

Ticket prices can jump once fees and demand kick in. Here’s how deal-alert and price-tracking apps help you spot real all-in totals, catch price drops, and grab discounts—without constant refreshing.

A no-spend challenge gets easier when an app does the tracking, rules, and reminders for you. Here’s a simple setup plus five practical apps to monitor spending, avoid slip-ups, and stay consistent.

Giveaway apps turn local “I don’t need this anymore” into your next free find. Here’s how the system works, what’s trending now, and five reliable apps to score free stuff nearby—safely.

Learn how currency exchange fees really happen while you travel—and how five practical apps help you dodge foreign transaction fees, bad exchange rates, and pricey “pay in your home currency” traps.

Cash envelope apps bring the classic “cash in envelopes” method to your phone—so you can set weekly caps, see what’s left instantly, and spend with less guilt and fewer surprises.

Impulse buying is usually a friction problem, not a “willpower” problem. Learn how app spending locks work and which five apps can help you block checkout moments, add delays, and stick to your budget.

Delivery fees aren’t the only problem—service fees, small-order fees, and markups quietly inflate your total. Here’s a simple “compare total checkout” routine and five apps that help you spend less.

Car repairs are getting pricier, but missed maintenance is still one of the easiest costs to prevent. Here’s how maintenance reminder apps help you stay ahead—plus five practical apps with pros, cons, and real-world tips.

Discover how to slash your fitness budget with the best home workout apps. We compare top-rated solutions like Nike Training Club and FitOn to help you stay fit for less.

Payoff calculator apps turn your messy mix of cards and loans into a clear payoff timeline. Learn snowball vs. avalanche, see real example numbers, and compare five practical apps with honest pros and cons.

Ride-hailing prices can vary a lot for the exact same trip. Here’s how fare-compare apps work, which ones are actually useful, and how to use them to cut ride costs without hassle.

Parking can quietly drain your budget. Here’s how spot-finder apps help you compare prices, reserve ahead, and avoid common overpaying traps—plus five practical apps I’d actually use to cut costs.

Mobile data gets expensive fast when a few “small” habits stack up. Here’s how data-usage tracking apps help you stay under your cap, spot data hogs, and avoid surprise overages.

Prices change fast online, and “was/now” tags don’t always tell the full story. Here’s how price-tracker apps work, what to watch for, and five practical tools I use to confirm real deals.

Transfer fees aren’t just “a small charge”—they’re usually a mix of upfront fees and hidden exchange-rate markups. Here’s how money-sending apps reduce total costs, plus five practical options.

Food waste quietly drains your budget. Here’s how meal-planning apps help you plan smarter, shop once, use what you already own, and cut the “bought but not eaten” problem—without making life complicated.

Tired of roaming surprises? Learn how eSIM apps help you compare data deals by destination, avoid pricey day passes, and control spending—with real stats and practical, tested-style tips.

Public transit can be cheap—or quietly expensive if you buy the wrong ticket. Here’s how to use apps to compare fares, spot caps, and pick the cheapest pass for your real weekly routine.

Learn a simple, phone-first system to capture receipts, organize purchases, and unlock refunds—returns, price adjustments, and cashback—using five practical apps that fit real family and solo budgets.

ATM fees are hitting record highs, but you can dodge most of them with the right cash-finder apps. Here’s how fee‑free ATM networks work, plus five practical apps I rely on.

Stop your 2026 financial resolution from failing. Discover the "Weekly Money Date" rule and how Monee, the award-winning budget app, helps families and singles stay on track.

Childcare can eat your budget fast. Here are 5 practical Android and iPhone apps that help you compare carers, book flexible babysitting, and avoid overpaying—plus UK schemes you can stack for bigger savings.

Restaurant prices have stayed stubbornly high, but deal apps can help you spend less without giving up eating out. Here’s how they work, what to watch for, and five apps that can realistically lower your bill.

Internet costs and streaming stacks add up fast. Here are five practical Android and iPhone apps I’ve used to track usage, rotate streaming services, negotiate bills, and prove when you’re overpaying.

Bills keep creeping up, but you don’t have to just accept it. Here are five practical Android and iPhone apps that help you negotiate, cancel, and rotate subscriptions—plus simple tactics to cut costs fast in 2026.

Late fees are avoidable—but only if you stop relying on memory. Here are 5 bill reminder apps for iPhone and Android that help you track due dates, get alerts, and stay ahead of recurring payments.

Money fights aren’t about math—they’re about messy tracking. Here are five roommate-friendly apps to split bills cleanly in 2026, plus practical habits (and a streaming-rotation trick) to stop budget bloat.

Overdraft fees are still an expensive “gotcha” in 2026. Here’s a simple, app-first playbook to get earlier balance alerts, time bills smarter, and spend fee-free—without living in your bank app.

Prescription prices can swing wildly between pharmacies. Here’s a practical 2025 playbook—plus five trusted discount apps—to compare local prices, grab coupons, and cut out-of-pocket costs for you and your family.

Pet care costs reached a record $147 billion last year. Discover the top 5 apps of 2025—including Chewy, Petco Vital Care, and Pawp—that help you slash vet bills, save up to 80% on prescriptions, and find affordable pet sitting. Start saving on your furry friend’s care today.

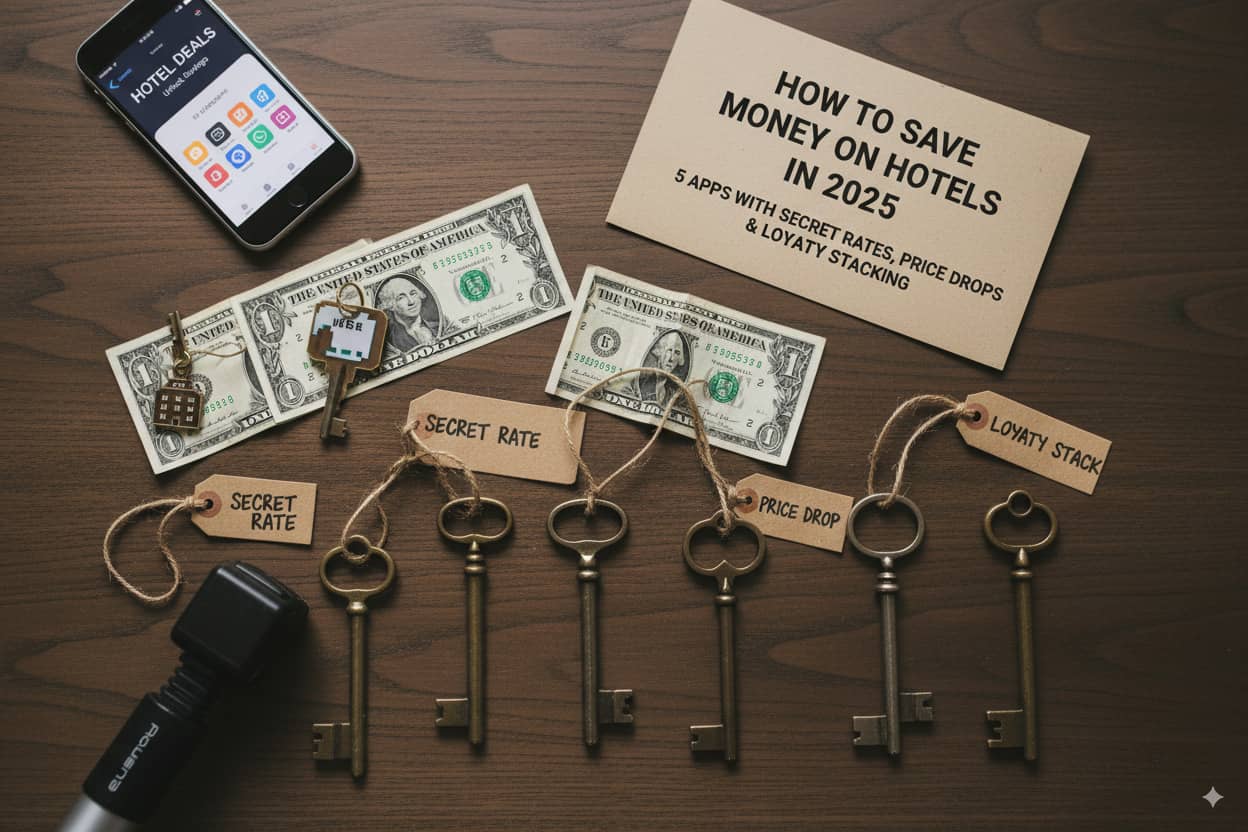

Find secret hotel rates & price drops in 2025. Use these top 5 apps to stack loyalty rewards and save money.

Find secret hotel rates & price drops in 2025. Use these top 5 apps to stack loyalty rewards and save money.

Protect your home and wallet with 2025’s top IoT water monitors—Flo, Flume, Phyn, LeakSMART & iQuarius. Catch leaks early, cut usage, and avoid bill spikes

Save big sustainably with Facebook Marketplace, OfferUp, Mercari, Poshmark & eBay—your guide to deals in 2025`s $479B second-hand market.

Learn 5 top tax apps and 2026 TCJA changes to boost your refund, claim credits like the EITC, and keep thousands more of your money this filing season.

Discover 2025`s best gamified budgeting apps turning daily spending into dopamine-fueled savings. Level up your finances and hit high-score goals today.

Premiums still rising—up 7.5% in 2025. Use these 5 telematics apps to save up to 30% on car insurance.

Phone bills avg $141 in 2025. Learn 5 free apps — WhatsApp, TextNow, Google Voice, Rocket Money & My Data Manager—to cut your costs by 50%.

Slash your 2025 streaming bill by rotating subscriptions. Discover the 36 % of viewers who hop services, plus 5 apps to track, cancel and save fast.

Cut 2025 campus costs fast: discover 5 AI-smart budgeting, cashback & investing apps students use to save $1K+ a year—no ramen diet required.

Stop paying $219/month for forgotten subs—these 7 2025 apps auto-cancel unused trials, curb subscription creep and save you $2.6K+ a year.

Learn how quarterly financial reviews can reduce money stress in just 15 minutes. Expert tips + tools to make budget checkups simple and effective.

Discover the hidden costs draining your bank account! From sneaky fees to subscription traps, learn how to find and eliminate financial leaks.

Drowning in financial apps? 100% of users struggle with complex banking software. Discover why simple budgeting tools win every time.

Beat inflation with 7 proven strategies that work in 2025. From smart budgeting to high-yield savings, protect your purchasing power today.

Stop fighting about money! Learn how couples can manage shared finances with open communication, smart budgeting strategies, and the right tools.

Discover why you buy things you don't need. Learn the psychology behind impulse spending and practical strategies to regain control of your finances.

Discover why 89% of people fail at budgeting and learn the 3-pillar strategy used by the successful 11%. Plus, find the right budgeting app for you.

Discover practical ways to track your spending and gain financial control. Learn expert methods and tools to manage your money effectively.

Discover how to save money effectively with Monee, a privacy-focused budgeting app that helps you track expenses, build an emergency fund, and develop better financial habits.

Discover the top 5 apps that can help you slash your electric bill in 2025. From smart thermostats to reward programs, these tools make energy savings easy and rewarding.

Discover the top 5 budget and expense tracker apps of 2025. Find the perfect financial tool to help you take control of your spending and achieve your money goals.

Discover 5 essential apps to save money on your daily commute amid high gas prices and rising inflation. Compare options for parking, trains, and more.

Discover the top 5 flight booking apps of 2025 that use AI and price tracking to help budget-conscious travelers save money on airfare with expert tips.

Discover the top 5 money-saving food apps of 2025 to slash your grocery bill, reduce food waste, and master meal planning. Save 15-30% on your food budget today!

Discover the top 5 utility-saving apps of 2025 that can cut your monthly bills by hundreds. From automatic rate negotiation to paid energy reduction programs.

Discover how fuel-finding apps can help you save up to 25 cents per gallon at the pump. Compare GasBuddy, Upside, AAA Mobile, and more money-saving options.

Discover how community-based financial apps like Temu, Arcadia, and Lemonade help you save money by pooling buying power with friends and neighbors.

Discover 5 must-have grocery saving apps for 2025 that can save you hundreds annually. Learn expert strategies to maximize cashback, points, and discounts on your weekly shop.

Tired of feeling like saving money is just another chore? What if your morning coffee run or daily walk could automatically build your savings without any extra effort? A new wave of "passive savings" apps is revolutionizing how we save by turning everyday activities into money-making opportunities. From Acorns, which invests your spare change from purchases, to Qapital, which rewards your fitness achievements with automatic savings, these innovative tools are helping people accumulate funds in the background of their busy lives. According to NerdWallet, users are often "surprised by how quickly those pennies accumulate" into meaningful investments. Discover how these apps can transform your routine habits into a stronger financial future—no willpower required.

Food prices are constantly rising, but your budget doesn't have to keep up! Discover proven strategies and apps that help German families save up to €1,800 annually on shopping - without sacrificing quality. From digital helpers like Too Good To Go to clever shopping strategies: This guide shows you how to cleverly save money on grocery shopping in 2025.